Though it is a common protection under a house owners insurance plan, additional living expense coverage can differ considerably from business to company. Some companies offer costs up to a certain overall limitation. Others do not have an expense limit however only use the protection for a minimal quantity of time after an event. ALE also will repay insurance policy holders for lease payable to them. For instance, say you lease part of your home but that portion of it became uninhabitable due to a peril covered by your policy. In that circumstance, ALE would pay you the lost income from the occupant who had to move until the space was repaired, subject to the terms of your policy.

These are coverages one does not typically consider when buying house owners insurance, however it is very important not to ignore them, if you would take advantage of having the coverage.: Companies usually pay sensible expenditures to eliminate particles on home from a covered peril that caused a loss. Ash, dust and particles from a volcanic eruption that triggered a direct loss or damage likewise fall under this category; trees downed by a danger are covered, too.: Property owners insurance coverage in some cases cover serious markers and mausoleums damaged or lost by a covered peril. The grave markers or mausoleums can be on or off the residential or commercial property of the policyholder's house.

: Protection that protects a property owner and pays to help them restore their identity in the occasion it is used fraudulently.: If a danger affects your house or residential or commercial property covered by your house owners insurance coverage, you'll have to have an expert damage assessment made. Depending on what is harmed and the extent of the damage, assessments may be expensive. The good news is, homeowners insurance coverage policies frequently cover loss assessments as much as a specific limit.: A lot of homeowners insurance coverage policies cover unauthorized charges to your credit card. Nevertheless, the limit on this is generally low ($ 500) and most credit card companies will get rid of unapproved charges from your card once you report them.

Some are apparent and some aren't so obvious. The two crucial to bear in mind of are and. Both are typical perils in some areas and have insurance coverage items designed specifically for each one. Homeowners insurance exclusions also differ in between business and from state to state. Some other things homeowners insurance will not cover include disregard or failure to make repairs, wear and tear, corrosion and rust, contamination, animals and bugs, fungi, nuclear hazards, power failure, federal government actions and war.

Select ... Select ... INTRODUCTION WHAT'S COVERED WAYS TO CONSERVE FAQ Home. It's your safe haven. It's where you raise your household and create memories that last a life time. Tourists can assist you safeguard this valued belongings with homeowners insurance coverage that fits your top priorities and your spending plan. When you're confident you have the coverage you need to assist protect your house and personal possessions, you can focus on those little minutes that matter. Getting a home insurance quote today fasts and easy. A Travelers agent can assist you identify the homeowners protection that finest fits your requirements and spending plan, however a normal policy can cover: The structure of your home Other structures on your residential or commercial property (e.

garage, shed) Your individual valuables Additional living expenses if you can not live in your home due to a covered loss Your personal liability or legal fees Limited important items (extra coverage can usually be included) Be sure to check out alternatives to tailor your limitations and protections to meet your requirements. Your property owners insurance coverage includes coverages in the following categories to assist ensure your home and properties are appropriately safeguarded. Residence protection can assist pay to repair or restore your home if it's harmed by a covered cause of loss. Some examples of the kinds of threats that may be covered include: Home fires Extreme weather condition Damage from pipes or device leaks Vandalism/theft Personal home protection can pay you for the individual products in your house that may be damaged or damaged by a covered cause of loss, which might include: Your furniture Clothing Sporting items Electronics Liability coverage can help secure you in the occasion of a claim and can provide a defense in the event of a claim if you or a relative in your home is accountable for causing physical injury or home damage to others.

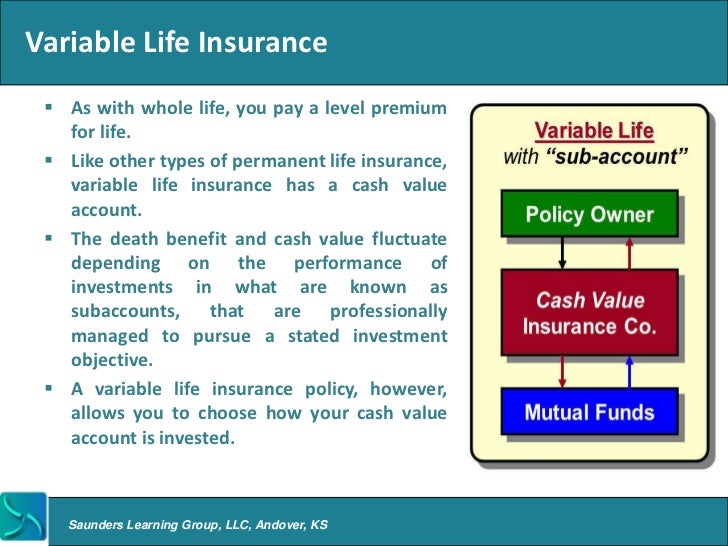

Some Of How Does Life Insurance Work

We'll ask for information such as when were your roofing system and energies last updated, and what kind of building and construction your home is. The method you utilize the home. We'll need to know if it is your primary home, or a secondary or rental home. Your present homeowners insurance coverage. We'll get a much better insight into your insurance requires when you share your existing service provider details and the length of time you've been insured. These information will help us find the homeowners insurance coverage policy that best fits your needs. Discover https://blogfreely.net/tricus04m9/it-can-decrease-your-insurance-plan-payment-since-youand-39-re-driving-less the responses to many of your typical property owners insurance concerns, including how to safeguard important products.

And your house insurance plan might not supply the protection you require (What does comprehensive insurance cover). This liability coverage may go above and beyond your automobile and house insurance coverage policies to assist safeguard you from unexpected events. Understanding that you, your guests and your vessel are secured can help More help you unwind and enjoy your time on the water. Water damage due to a pipes problem in your house can be life-changing. However there are some common signs that homeowners can look for, and steps they can take, to assist avoid a major water problem in your home. Though innovation can ease a number of the obstacles associated with working from home, it can't constantly help you stay productive.

Though technology can alleviate much of the obstacles related to working from house, it can't constantly help you stay productive. If you're finding it tough to remain on top of your jobs or satisfy your deadlines while working from house, these 10 tips can assist. Select ... Select ... INTRODUCTION WHAT'S COVERED WAYS TO SAVE Frequently Asked Question.

A kind of property insurance coverage that covers a personal house House insurance coverage, likewise commonly called homeowner's insurance (often abbreviated in the United States realty market as HOI), is a kind of property insurance coverage that covers a personal house. It is an insurance policy that integrates numerous personal insurance coverage protections, which can consist of losses happening to one's house, its contents, loss of use (additional living expenditures), or loss of other individual belongings of the property owner, in addition to liability insurance coverage for accidents that might occur at the home or at the hands of the homeowner within the policy territory. Furthermore, property owner's insurance coverage supplies financial protection versus Check out here catastrophes.